How Health Insurance Can Save You Money and Protect Your Future

Understanding the Basics of Health Insurance

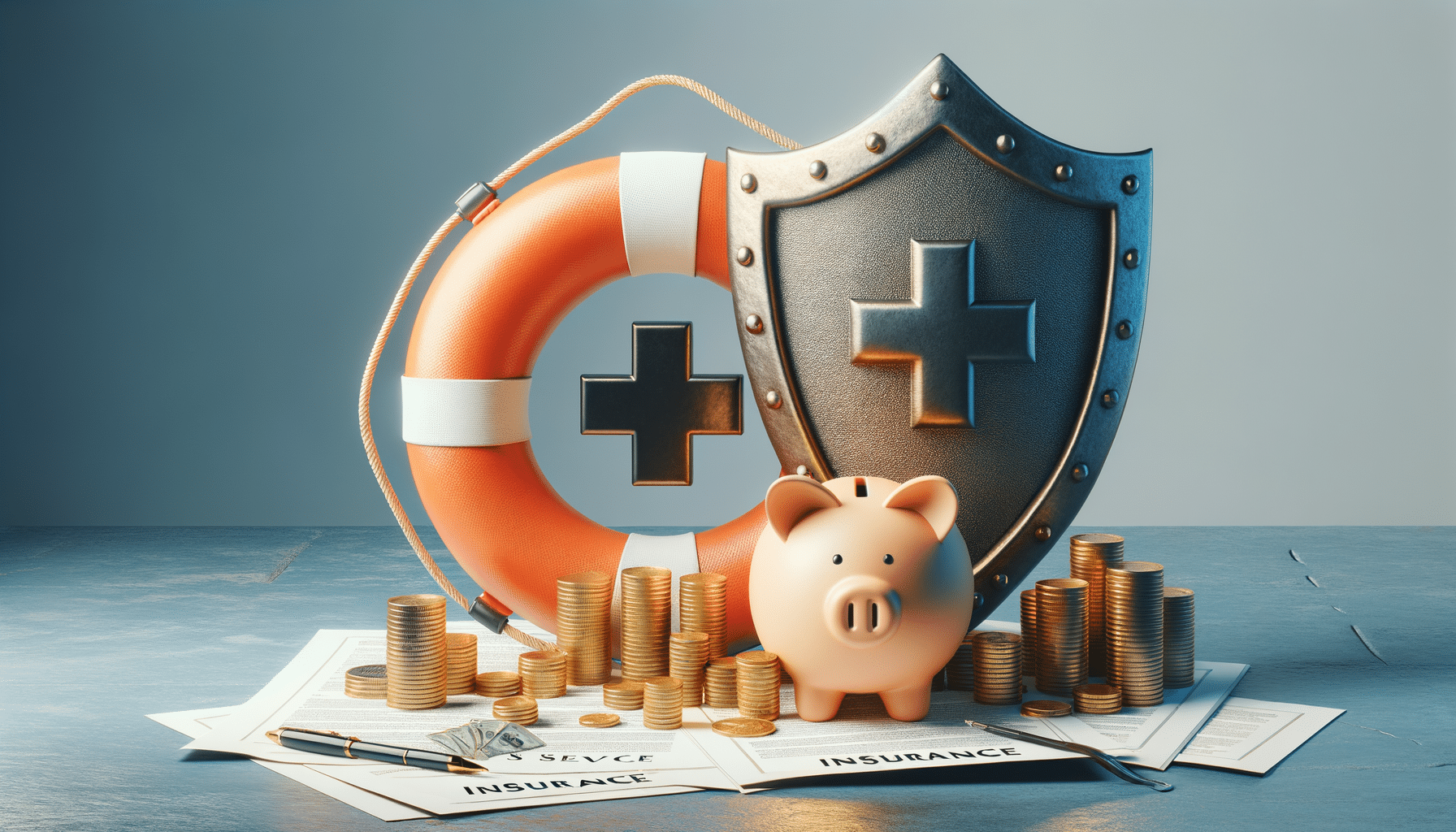

Health insurance is a contract between you and an insurance provider that covers medical expenses in exchange for a premium. It serves as a financial safety net, protecting you from the high costs of healthcare. There are various types of health insurance plans, each with its own set of benefits and limitations. These plans can be obtained through an employer, purchased individually, or provided by government programs.

One of the key elements of health insurance is the premium, which is the amount you pay regularly to maintain coverage. Additionally, policies may include deductibles, copayments, and coinsurance, which are out-of-pocket expenses you must pay before the insurance kicks in fully. Understanding these components helps you make informed decisions about your healthcare needs and financial planning.

Health insurance not only covers routine check-ups and preventive care but also provides coverage for more significant medical needs, such as surgeries, hospital stays, and specialized treatments. By sharing the risk among a large group of people, health insurance makes healthcare more affordable for everyone.

The Financial Benefits of Health Insurance

One of the most compelling reasons to have health insurance is its ability to mitigate financial risk. Medical emergencies can arise unexpectedly, leading to substantial expenses. Without insurance, these costs can be overwhelming, potentially leading to financial distress. Health insurance helps manage these expenses by covering a significant portion of your medical bills.

For example, consider a scenario where you need emergency surgery. The costs can quickly escalate into tens of thousands of dollars. With health insurance, a large portion of these expenses is covered, leaving you responsible for a much smaller amount. This protection is invaluable, ensuring that an unexpected health issue doesn’t lead to financial ruin.

Moreover, health insurance often includes preventive care services, which can help detect health issues early, reducing the need for more expensive treatments later. Regular check-ups, screenings, and vaccinations are typically covered, promoting better long-term health and cost savings.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan involves evaluating your healthcare needs, budget, and preferences. Plans vary in terms of coverage, cost, and network of healthcare providers. It’s important to consider factors such as premiums, deductibles, and out-of-pocket maximums when comparing options.

One of the top options for many individuals is a plan that balances cost with comprehensive coverage. For those with specific health needs, a plan offering specialized care might be more appropriate. It’s also crucial to assess the network of doctors and hospitals included in the plan to ensure access to preferred providers.

Employers often offer multiple plan choices, allowing employees to select the one that best fits their needs. For those purchasing insurance independently, online marketplaces provide a platform to compare different plans. Taking the time to research and compare options can lead to a more satisfying and cost-effective healthcare experience.

Health Insurance and Peace of Mind

Beyond the financial benefits, health insurance offers peace of mind. Knowing that you have coverage in place for unexpected medical events alleviates stress and allows you to focus on recovery rather than worrying about expenses. This sense of security is invaluable, especially in times of health crises.

Health insurance also provides access to a wide range of healthcare services, ensuring you receive the care you need when you need it. This access is crucial for maintaining overall well-being and addressing health issues promptly. With insurance, you can seek medical attention without hesitation, knowing that your policy will help cover the costs.

In addition to providing financial protection, health insurance fosters a proactive approach to health management. By encouraging regular check-ups and preventive care, insurance helps you stay on top of your health and catch potential issues early. This proactive mindset can lead to healthier outcomes and a better quality of life.

Conclusion: The Importance of Health Insurance

In conclusion, health insurance is a vital component of financial planning and health management. It offers protection against the high costs of medical care, ensuring that you are not left with overwhelming expenses in the event of illness or injury. By covering a significant portion of medical bills, health insurance provides peace of mind and financial security.

Choosing the right health insurance plan requires careful consideration of your healthcare needs and budget. With the right coverage, you can enjoy access to a wide range of healthcare services, promoting better health outcomes and a more secure financial future.

Ultimately, health insurance is an investment in your well-being and financial stability. It ensures that you are prepared for whatever healthcare challenges come your way, allowing you to focus on what truly matters—your health and happiness.