How Health Insurance Can Save You Money and Protect Your Future

Understanding the Basics of Health Insurance

Health insurance is a critical component of financial planning, offering protection against the high costs of medical care. At its core, health insurance is a contract between you and an insurance provider, where you pay a premium in exchange for coverage of specific medical expenses. This coverage can include doctor visits, hospital stays, preventive care, and even prescription medications.

One of the primary reasons people opt for health insurance is to mitigate the risk of unexpected medical expenses. Without insurance, the cost of a single hospital visit or a necessary surgery can be financially overwhelming. Health insurance helps manage these costs by covering a significant portion of the bills, allowing you to focus on recovery rather than financial stress.

Moreover, having health insurance often grants you access to a network of healthcare providers and facilities, ensuring you receive timely and effective care. This network can include general practitioners, specialists, and hospitals, providing a comprehensive support system for your health needs.

- Coverage of routine check-ups and preventive care

- Access to a network of healthcare providers

- Financial protection against unexpected medical expenses

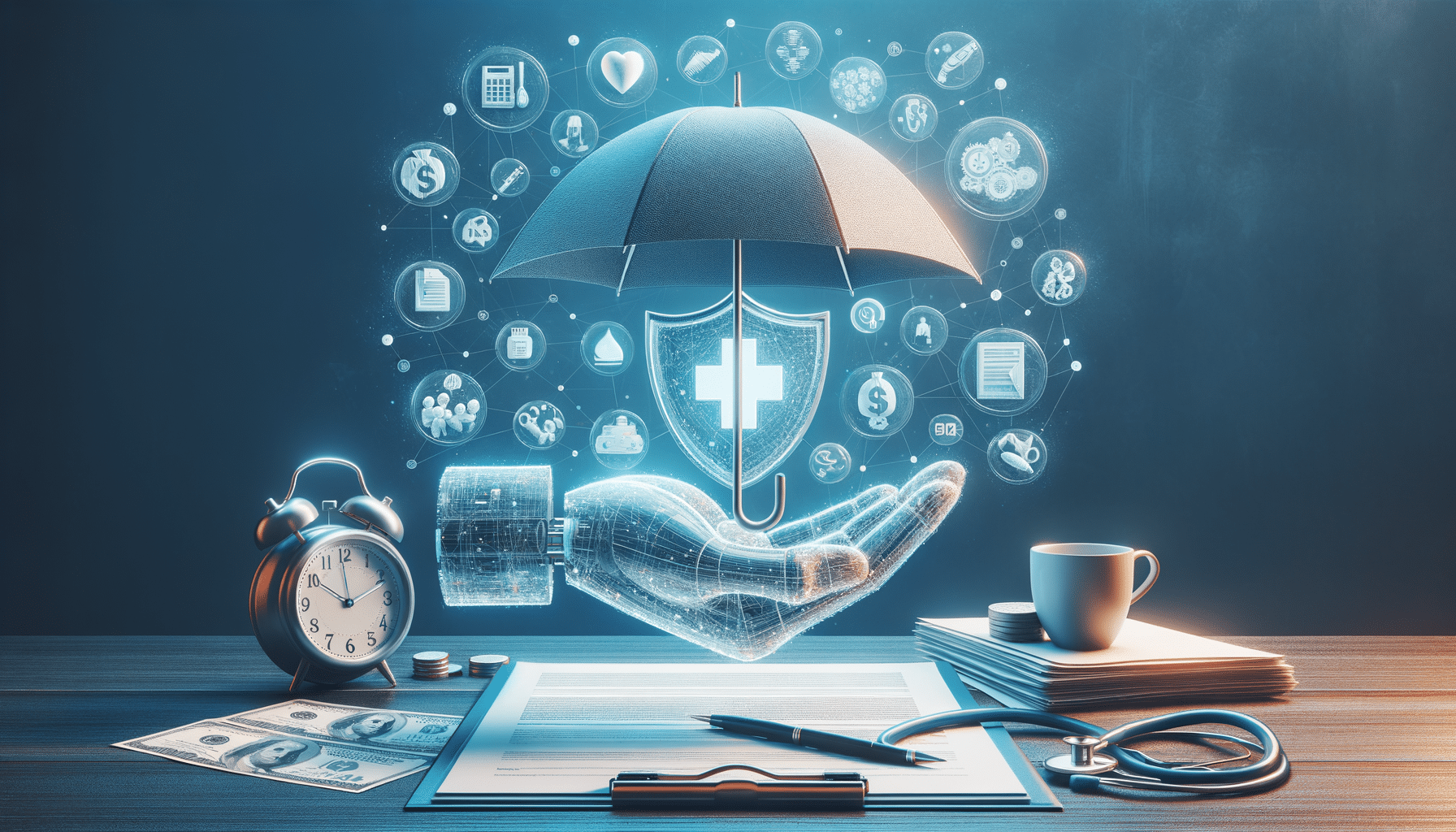

The Financial Benefits of Health Insurance

Investing in health insurance can lead to substantial financial benefits. While paying premiums might seem like an added expense, it is a proactive measure that can save you money in the long run. With health insurance, you are less likely to face the full brunt of medical bills, which can be exorbitant without coverage.

For instance, consider the cost of a routine surgery. Without insurance, you could be looking at thousands of dollars in expenses. However, with a comprehensive health insurance plan, a significant portion of these costs would be covered, reducing your out-of-pocket expenses dramatically. This financial relief can be crucial, especially during times of medical emergencies.

Additionally, health insurance often covers preventive services at no extra cost. These services include vaccinations, screenings, and annual physical exams, which can help catch potential health issues early, preventing costly treatments down the line.

- Reduced out-of-pocket expenses during medical emergencies

- Coverage for preventive services at no additional cost

- Financial relief through lower costs of routine medical procedures

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan can be daunting, given the myriad of options available. It’s essential to assess your health needs and financial situation to make an informed decision. When evaluating plans, consider factors such as premium costs, coverage limits, and the network of providers.

One of the critical aspects to examine is the premium versus deductible balance. A lower premium may seem attractive, but it often comes with higher deductibles, meaning you’ll pay more out-of-pocket before the insurance kicks in. Conversely, higher premiums usually mean lower deductibles, which can be beneficial if you anticipate frequent medical visits or treatments.

It’s also vital to understand the specifics of what each plan covers. Some plans may offer extensive coverage for specialist care, while others might focus on basic medical services. Ensure the plan you choose aligns with your healthcare needs and lifestyle.

- Balance between premiums and deductibles

- Coverage specifics and network of providers

- Alignment with personal health needs and financial situation

The Role of Health Insurance in Preventive Care

Health insurance plays an integral role in promoting preventive care, which is crucial for maintaining long-term health. Preventive care services are designed to prevent illnesses and detect health issues early when they are most treatable. These services often include screenings, immunizations, and wellness visits.

Most health insurance plans cover preventive services at no additional cost to the insured. This coverage encourages individuals to undergo regular health check-ups and screenings, which can lead to early detection of conditions such as diabetes, high blood pressure, and cancer. Early detection often results in more effective treatment and better health outcomes.

Furthermore, preventive care helps reduce the overall cost of healthcare by minimizing the need for more extensive and expensive treatments. By catching potential health issues early, patients can avoid the high costs associated with advanced medical interventions.

- Coverage for screenings and immunizations

- Early detection of health conditions

- Reduction in overall healthcare costs

Health Insurance and Peace of Mind

Beyond the financial and medical benefits, health insurance provides peace of mind, knowing that you and your loved ones are protected against unforeseen medical events. This assurance allows individuals to focus on their daily lives without the constant worry of potential medical expenses.

With health insurance, you have the confidence that you can access necessary medical care without the fear of financial ruin. This security is particularly important in emergencies, where timely medical intervention can be life-saving.

Moreover, health insurance can alleviate the stress associated with navigating the complex healthcare system. Many insurance providers offer support services to help you find the right doctors, schedule appointments, and manage claims efficiently.

- Protection against unforeseen medical events

- Access to necessary medical care without financial worry

- Support services for navigating the healthcare system