Oil Investment: Exploring Opportunities with Oil and Gas Investment Companies

Introduction to Oil Investment

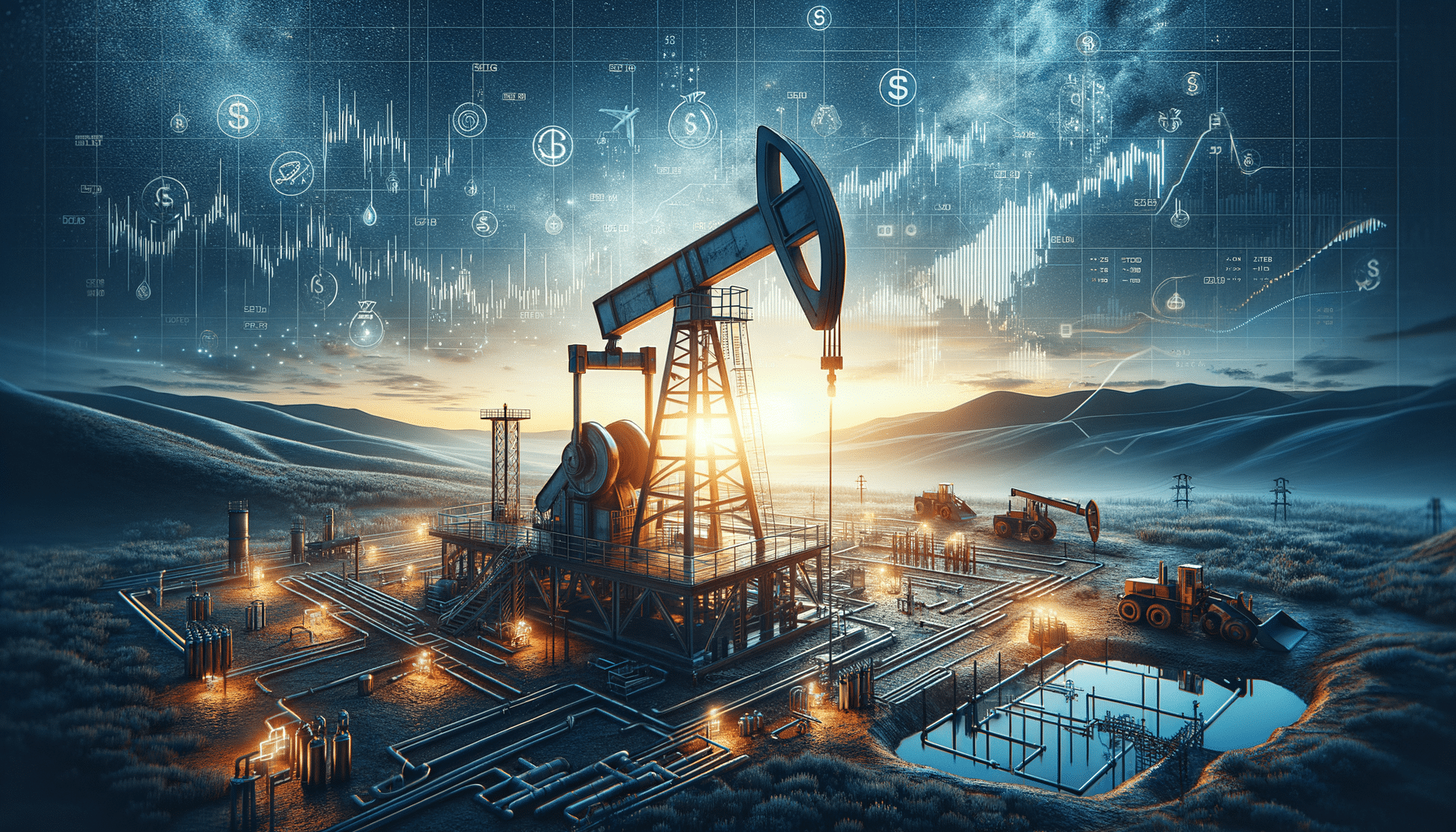

Oil investment has long been a cornerstone of global economic development. As one of the most important energy sources, oil plays a crucial role in powering industries, transportation, and homes. For investors, the oil sector represents a dynamic and potentially lucrative opportunity. By understanding the nuances of oil investment, individuals can make informed decisions that align with their financial goals.

Oil and gas investment companies serve as intermediaries, providing access to a range of investment opportunities. These companies leverage their industry expertise to identify promising ventures and manage the complexities associated with oil investments. With the global demand for energy on the rise, investing in oil and gas assets remains a compelling option for those seeking to diversify their portfolios.

The Role of Oil and Gas Investment Companies

Oil and gas investment companies play a pivotal role in facilitating access to the energy sector for investors. These entities possess specialized knowledge and resources, allowing them to identify and evaluate investment opportunities effectively. By partnering with oil and gas investment companies, investors can benefit from:

- Industry Expertise: These companies employ professionals with extensive experience in the energy sector, providing valuable insights and guidance.

- Diverse Investment Options: From exploration and production to refining and distribution, investment companies offer a range of opportunities across the oil and gas value chain.

- Risk Management: With a deep understanding of market dynamics, these companies help mitigate risks associated with oil investments.

By leveraging the capabilities of oil and gas investment companies, investors can navigate the complexities of the energy market with greater confidence and clarity.

Understanding Market Dynamics

The oil market is influenced by a myriad of factors, including geopolitical events, supply and demand fluctuations, and technological advancements. Understanding these dynamics is crucial for investors looking to capitalize on oil investment opportunities.

Geopolitical tensions can significantly impact oil prices, as conflicts in key oil-producing regions may disrupt supply chains. Additionally, shifts in global demand, driven by economic growth or policy changes, can lead to price volatility. Technological innovations, such as advancements in drilling techniques or renewable energy sources, also play a role in shaping the oil market landscape.

Investors must stay informed about these market dynamics to make strategic decisions. Oil and gas investment companies often provide valuable market analysis and forecasts, helping investors anticipate trends and adjust their portfolios accordingly.

Investment Strategies in the Oil Sector

Investing in the oil sector requires a strategic approach, as the market is characterized by both opportunities and risks. Several investment strategies can be employed to maximize returns:

- Direct Investment: Investors can directly purchase shares in oil companies, gaining exposure to their financial performance and dividends.

- Exchange-Traded Funds (ETFs): ETFs offer a diversified approach, allowing investors to hold a basket of oil-related assets, reducing risk.

- Futures Contracts: For those comfortable with higher risk, futures contracts allow investors to speculate on future oil prices.

Each strategy has its own set of advantages and considerations, and investors should align their choices with their risk tolerance and investment objectives. Oil and gas investment companies can provide tailored advice, helping investors select the most suitable strategies for their needs.

Conclusion: Embracing Opportunities in Oil Investment

Oil investment continues to be a vital component of the global energy landscape. With the support of oil and gas investment companies, investors can access a wealth of opportunities in this dynamic sector. By understanding market dynamics, leveraging industry expertise, and adopting strategic investment approaches, individuals can position themselves to capitalize on the potential growth of oil and gas assets.

As the world navigates the transition to sustainable energy sources, the oil sector remains a critical player in meeting current energy demands. For investors, embracing the opportunities presented by oil investment can lead to meaningful financial growth and diversification.